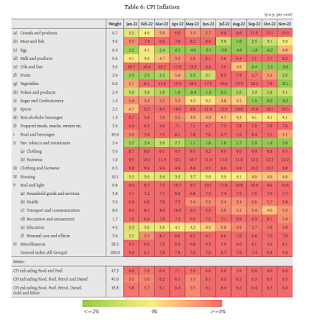

Education, housing, prepared meals, fuel and light, cereals, milk, household goods, and clothing have notable weights in CySI. These goods and services have prices that are mostly determined in domestic markets and are less affected by weather changes at least over the past decade.

On the other hand, sub-groups like transport and communication, oils and fats, and personal care and effects imbibe a large international influence. They get zero or negligible weights in the CySI. Most of the other food groups like vegetables and fruits, which are affected by supply and influenced by climatic changes, also enter CySI with negligible weight.

During the pandemic period (since Q1 of 2020 up to Q2 of 2021), CySI has remained persistently lower than aCySI, indicating that the supply disruptions were determining headline inflation, not demand factors. The aCySI-CySI gap closed in the second half of 2021 but widened after February 2022. Supply shocks driving the acyclical component of inflation were the principal contributors to the ascent of inflation.

On a note of caution, the contribution of CySI to headline inflation seems to be rising in recent months, narrowing the gap between aCySI and CySI till it turned negative since October 2022. The generalization of inflationary pressures that is being flashed indicates the increasing role of demand-pull, warranting monetary policy action to combat second-round effects.

The examination of the latent drivers of inflation’s ascent point to the conclusion that inflation surging above the upper tolerance band of the target was kick-started by a series of supply shocks, induced first by COVID-19 and then followed up by the war in Ukraine and weather-related uncertainties. How some of these shocks led to generalization and persistence in inflation thereafter deserves focus. All those are assimilated into a macro model to identify the inter-temporal determinants of inflation, using the Reserve Bank of India’s (RBI’s) Quarterly Projection Model (QPM).

The QPM belongs to the genre of consensus macroeconomic New Keynesian open economy structural models (Benes et al., 2016 & RBI, 2021). Drawing on this tradition, it consists of 1) an aggregate demand equation; 2) expectations augmented Philips curve; 3) a monetary policy rule; and 4) an external block for the determination of exchange rates.

A defining feature is a focus on nominal rigidities in price/wage settings and in mark-ups, providing monetary policy the exploitable trade-off to affect goal variables like output and inflation. Trend variables like potential output are assumed to be supply-driven and are, therefore, exogenous to the model. inflation is a result of deviations of aggregate demand from its underlying trend.

In India, the prominence of food and fuel in the consumption basket amplifies the dominance of supply-side shocks and spillovers to the formation of overall inflation. Therefore, such country-specific characteristics are incorporated into the QPM, enabling gains in empirical regularity. It embeds many India-specific features like the behavior of different inflation components and their interlinkages, sluggishness in monetary policy transmission, the predominance of the bank lending channel, central bank credibility, monetary-fiscal linkages, fuel pricing, capital flow management, and exchange rate dynamics.

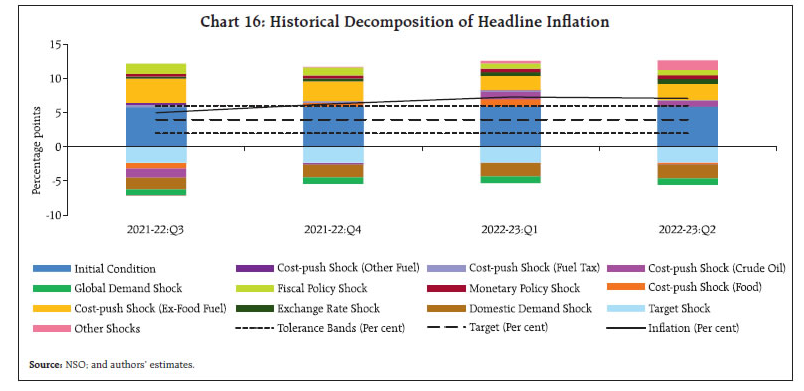

The historical decomposition (HD) of headline inflation in the QPM helps to understand the key macro contributors to inflation’s ascent during the period of study).

In Q4 of 2021-22, inflation averaged 6.3 percent. COVID-19-induced supply disruptions and their impact on core inflation accounted for more than half of the rise in inflation above the target. Food price shocks contributed around 22 percent and exchange rate pass-through contributed 16 percent.

As we begin a new year, it is a good time to reflect

upon our journey so far and what lies ahead. When

I look back, it is heartening to note that the Indian

economy successfully dealt with multiple major shocks

in the last three years and has emerged stronger than

before. India has the inherent strength, an enabling

policy environment, and strong macroeconomic

fundamentals and buffers to deal with future

challenges. I am reminded here of the words of Netaji

Subhas Chandra Bose: “……..never lose your faith in

the destiny of India”. Thank you. Namaskar. ~ RBI Governer

Get ii-Trader & Swinger FREE